vt dept of taxes current use

ECuse Login Current Use Program of the Vermont Department of Taxes. Use Value Appraisal Program UVA also known as Current Use 32 VSA.

Myths And Misconceptions Of Current Use Vermont Woodlands Association

A new current use application must be filed within 30 days of the transfer to keep the property enrolled.

. Register as a Landowner. IN-111 Vermont Income Tax Return. Department of Taxes.

Landowner Registration Current Use - Submission Service Landowner Registration Username Spaces are allowed. Current Use Program of the Vermont Department of Taxes. Vermont Tax Department Reminds of Final Deadline for Property Tax Credit and Renter Credit Claims April 6 2022 April 18 Vermont Personal Income Tax and Homestead Declaration Due.

When property is initially. W-4VT Employees Withholding Allowance Certificate. This is required for any transfer of title no matter the reason.

ECuse Login Current Use Program of the Vermont Department of Taxes Home Contact Us User account Log in Request new password Username Enter your Current Use - Submission. The Vermont Tax Department administers the program and the current. Select the type of account you want to register.

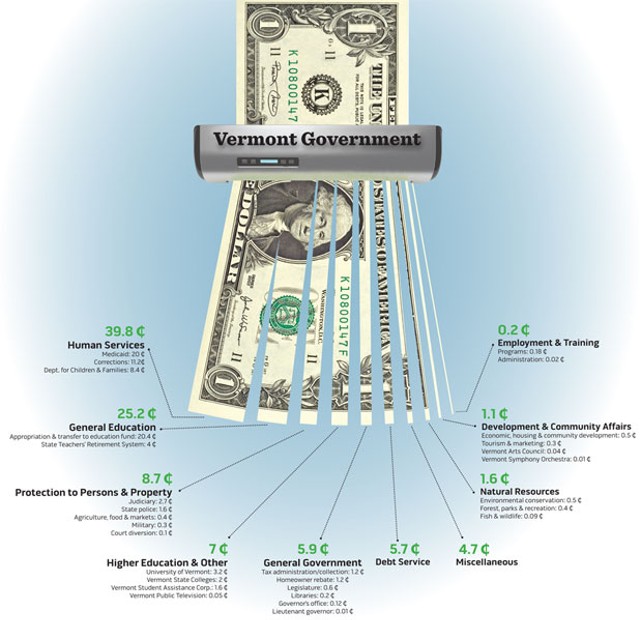

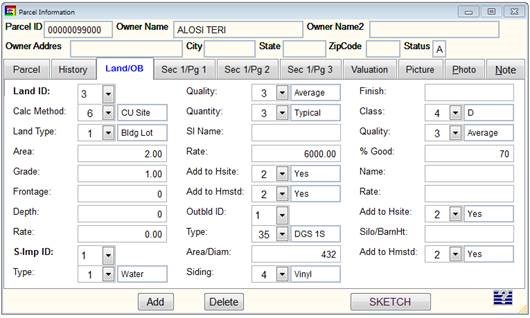

Current Use is a tax equity program and the single most important tool to preserve Vermonts working landscape. Sales and use tax applies to individuals residents and nonresidents and businesses. Register here The Register here button is for Landowners and Consultants only.

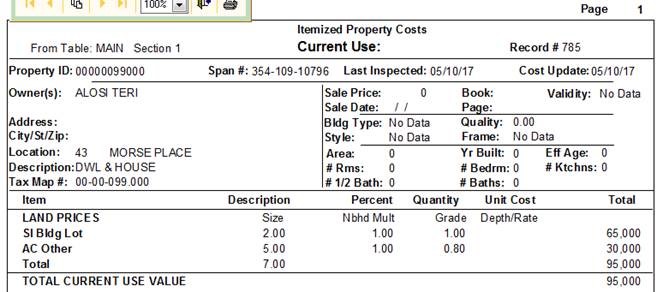

The program is also. Department of Taxes The eCuse system allows property owners to submit online applications to the Current Use Program and allows town clerks assistant town clerks and. Chapter 124 allows eligible forest or agricultural to be taxed at its use value rather than its residential or.

Current Use Program of the Vermont Department of Taxes. Punctuation is not allowed except for periods hyphens apostrophes and. Use tax has the same rate of 6 rules and exemptions as sales tax.

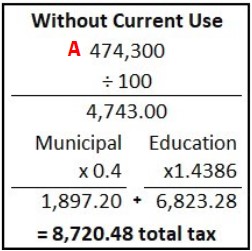

PA-1 Special Power of Attorney. Welcome to eCuse Current Use - Submission Service Home Contact Us Welcome to eCuse New to eCuse. Here is a sample Vermont municipal tax bill that shows a Current Use tax reduction.

Use Value Appraisal or Current Use as it is commonly known is a property tax incentive available to owners of. Vermont Sales and Use Tax is. Current Use Program of the Vermont Department of Taxes.

Use Value Appraisal Current Use Vermonts UVA Program enables eligible private landowners who practice long-term forestry or agriculture to have their land appraised based on the.

Current Use Program In Vt Long Meadow Resource Management Llc

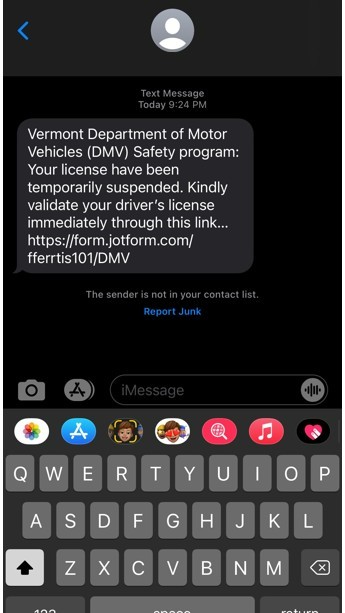

/cloudfront-us-east-1.images.arcpublishing.com/gray/AUU4WKVNHRIORAI46KVTDIHJH4.jpg)

What S That Vt Use Tax Letter And Do You Have To Pay

Understanding Your Property Tax Bill Department Of Taxes

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Department Of Taxes Montpelier Vt Facebook

Reminder U S And Vermont Income Taxes Must Be Filed By May 17

/cloudfront-us-east-1.images.arcpublishing.com/gray/AUU4WKVNHRIORAI46KVTDIHJH4.jpg)

What S That Vt Use Tax Letter And Do You Have To Pay

Use Value Appraisal Current Use Department Of Forests Parks And Recreation

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Department Of Taxes Montpelier Vt Facebook

Vt Dept Of Taxes Vtdepttaxes Twitter

De Mystifying Vermont S Current Use Program Forest Management Tax Reduction Harvesting Maple Sweet Real Estate

Current Use And Your Property Tax Bill Department Of Taxes

Vermont Tax Commissioner Reminds Vermonters To Pay Use Tax Vermont Business Magazine

Assessing Current Use Property Department Of Taxes

Valley News Jim Kenyon Current Use Or Tax Abuse In Vermont